Return Invoice

A sales return happens when a customer returns an item due to defects, incorrect quantity, or other reasons. When merchandise is returned, the seller must record the return in their accounting records.

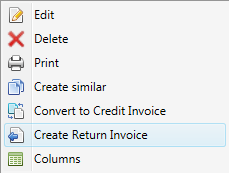

To create a Return Invoice, select the invoice from the list, right-click it, and choose Create Return Invoice from the hidden menu. The Return Invoice will be generated based on the selected invoice, including all details and quantities.

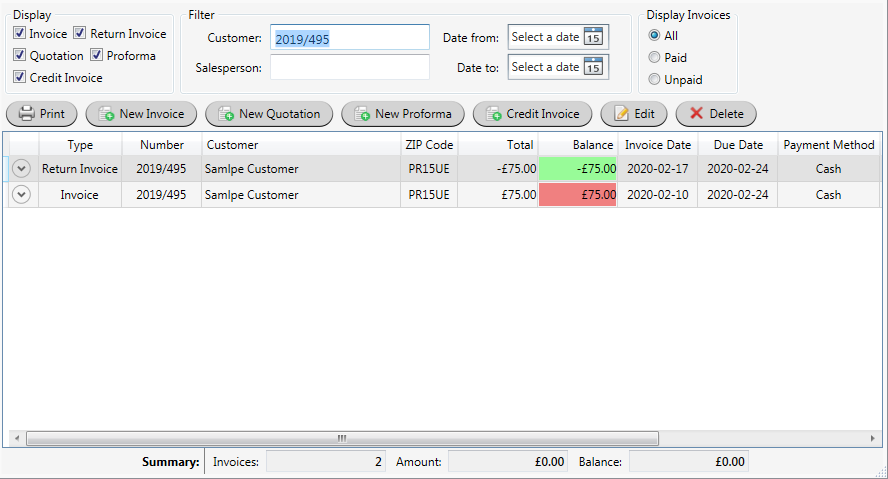

As you can see, the numbers on the Return Invoice are negative because the customer’s balance must be reduced. Partial returns are also supported—you can edit the return invoice to adjust item quantities.

The Return Invoice shares the same number as the original invoice, allowing you to quickly find both in the list.

Stock Control

If you use the Stock Control feature, returned items are added back to inventory. This option is conditional, and you will be prompted about it when saving the Return Invoice.

Sales Return Report

The Reports module includes a Sales Return report based on Return Invoices.

Overdue Report

The Overdue report helps you identify invoices that are still outstanding. A Return Invoice is linked to its original invoice and reduces its balance. If the original invoice amount minus the Return Invoice amount equals zero, the invoice is considered balanced and will not appear in the Overdue report.